QuickBooks allows you to keep track of financial functions like income and expenses, employee expenses and inventory in real time and fulfill tax obligations hassle-free. When you are free of financial worries, you can focus on driving business growth and revenue. Invoicing is one of the most crucial functions for many businesses, especially those that provide services or rely on freelancers.

QuickBooks for accountants

This will provide you with a comprehensive overview of this valuable tool, offering businesses a smoother accounting experience. Also, any expense entered can be marked as billable and assigned to a customer. As with time, these billable expenses will be available to add to the customer’s next invoice. You don’t need the payroll add-on to track employee time for billing purposes. You need at least the QuickBooks Online Essentials plan to track billable hours and the Plus subscription to track billable expenses. Accounting CPA is a top-notch CPA firm in Colorado Springs that provides excellent accounting and Tax services for small businesses.

© 2024 Intuit Inc. All rights reserved

In the “Home” tab of the Excel ribbon, click the “Conditional Formatting” button. Excel offers a wide range of options, such as highlighting cells that contain specific text or are greater than or less than a certain value. Learn how to enter a prior balance for a customer that owes you money or a vendor you need to pay.If you’re new to QuickBooks Online, you might have customers or vendors with open balances. We’ll show you the recommended way to manage those balances as you’re creating your customer and vendor profiles. Customizing invoice templates, setting recurring invoices, and tracking payments against invoices can streamline operations.

How is QuickBooks different from Microsoft Excel?

This section explores the core features like invoicing, expense tracking, reporting, bank reconciliations that enable users to control finances. QuickBooks Online is the largest and most popular cloud-based product for functions like balancing bank accounts, https://www.quick-bookkeeping.net/state-unemployment-insurance-sui-rates/ managing your business’s finances, and tracking expenses automatically. With this option, you are guided through the setup process for a smooth start. QuickBooks Online is an ideal product for professional, retail, or service-based businesses.

Tracking Expenses and Bills

Note you can also paste the data as a picture in Word by using the “Paste Special” feature and choosing to paste it as a picture. To use the “Find & Select” tool, first, navigate to the “Home” tab in the Excel ribbon, then select the “Find & Select” drop-down menu. Now go to the “Developer” tab, click “Insert,” and select the checkbox option. To select an entire column, press Ctrl + Spacebar on Windows or Cmd + Spacebar on Mac. Like the select an entire row shortcut, it allows you to quickly make a selection to manipulate, format, or analyze data.

If you want the speed and usability of desktop software, then QuickBooks Desktop is preferable. If you’re using QuickBooks Online, you or your accountant can easily transfer all the needed tax information through a tax preparation program like TurboTax. Bookkeepers and accounting professionals using QuickBooks Accountant can simplify tax preparation through ProConnect, a professional tax management solution. By managing all of your cash inflow and outflow activities in QuickBooks, you can print financial statements that provide useful information about how your business is performing.

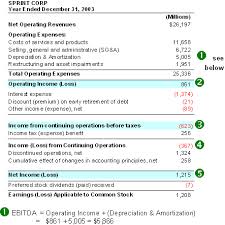

A cash flow statement shows how changes in your income and overall balance sheet affect your liquidity at the moment represented by your cash and cash equivalents. On this statement, you’ll see financials broken down by operations, investments, and financing. Besides, QuickBooks allows you to enter bills as you receive them, enabling effective tracking of upcoming payments. This feature ensures you have a clear overview of pending bills, aiding in timely payment management. QuickBooks Online is cloud-based software that can be accessed anytime and anywhere from any internet-enabled device and has monthly subscription options.

Applying filters to your data allows you to quickly sort, search, and analyze information—making it easier to find and work with the data you need. To add a filter in Excel, simply click on the Data tab in the toolbar and select “Filter.” This will add drop-down Arrows next to each of the column headers in your data. Excel will automatically add the same number of rows or columns that were highlighted and shift the existing data down or to the right to accommodate the new additions. This method is especially useful when a large number of rows or columns need to be added.

You have easy access to all the common financial statements like balance sheet, profit and loss (P&L) statement, cash flow statements and taxes filed. You can take a printout of these statements for your accountant and send it across to them at the time of filing or invite them to view these statements without needing a login ID or password. The payroll add-on calculates payroll automatically as often as you want.

This can be useful for tasks like merging first and last names, creating full addresses, or assembling various data points. When you add a vendor opening balance, QuickBooks creates a generic bill for the vendor. Or, you can void or delete the invoice and follow the steps above to add the https://www.personal-accounting.org/ specific invoices the customer hasn’t paid yet. These tools transform financial data into actionable business intelligence for smarter decision making. This allows businesses to closely monitor stock levels, streamline fulfillment, and make data-driven decisions around inventory planning.

Generate profit and loss reports through the “Report Center” to get a snapshot of your accounts receivable, budgets, cash flow, etc. An income statement, showing your profit margin, allows you to see how well your business is doing and if costs fiscal year and fiscal period need to be cut in certain areas. If you’re constantly worried about being paid on time, software with invoicing features is a necessity. With the ability to customize an invoice, you can include your company logo, contact information, and more.

For all its capabilities, QuickBooks online can be challenging for those who aren’t fully prepared or know all its features. No more lost receipts or manually matching up receipts with downloaded bank statements. QuickBooks allows you to attach a receipt to the corresponding banking transaction. You’ll simply take a photo of your receipt, upload it into the system, review it for inaccuracies, and save it. QuickBooks assists in managing all aspects of your business’s finances and remains the forerunner for small businesses, the self-employed, large enterprise, and any sort of business in between. One of the key uses of QuickBooks is how easy it makes tax preparation for small businesses.

- The reporting feature is the ideal feature that managerial personnel find QuickBooks the most helpful.

- Balance sheet items are calculated by subtracting your liabilities — what you owe — from your assets, cash or property — what you’re own or is owed to you.

- Easily embed your Excel data, charts, and tables directly into Microsoft Word documents, allowing you to combine your spreadsheet analysis with written reports or presentations.

- By doing so, all your expenses are downloaded and categorized automatically.

- It’s also essential for the small business owner to get a true sense of how their business is doing.

This tutorial covered getting started with QuickBooks as well as using features like invoicing, expense tracking, reporting, and more. Integrations further extend capabilities to meet specific business needs. If a quick and cheap accounting solution is your aim, QuickBooks probably isn’t for you. QuickBooks Online Simple starts at $25 per month, but it includes only one account user, no time tracking, bill pay, or inventory management. For time tracking and bill pay, you’ll need to upgrade to Essentials at $50 per month—and for inventory management, you’ll need to cough up $80 per month.